on the crypto

How to secure your cryptocurrencies. Some indications not to lose sight of the aspect of cryptocurrency security!

As known, one of the "typical" characteristics of the cryptocurrency it is inherent in their virtuality. Unlike most other forms of currency, in fact, the criptovaluta it has no physical incarnation. You cannot "take" and spend in the form of paper, money, gold bars or stones. There isn't any token that it must be locked in a bank vault, or placed under a mattress.

Of course, this does not mean that you can manage them cryptocurrency lightly. Indeed, as it happens for anything of value, the criptovaluta must be adequately protected. But how do you do it?

Default Exchange wallets are risky

Many newbies from the cryptocurrency Buy assets from a Exchange like Coinbase, and leave their digital money in the internal wallets of the Exchange itself. However, it is a practice that we do not recommend following, as like any other online entity, exchanges are also vulnerable to hacking, and your wallets would therefore also be at risk. How can we forget what happened to Mt. Gox in 2014, which "lost" 750.000 bitcoins of its customers, or to NiceHash, which was stolen for 2017 million dollars in 60?

Better to use "cold" wallets

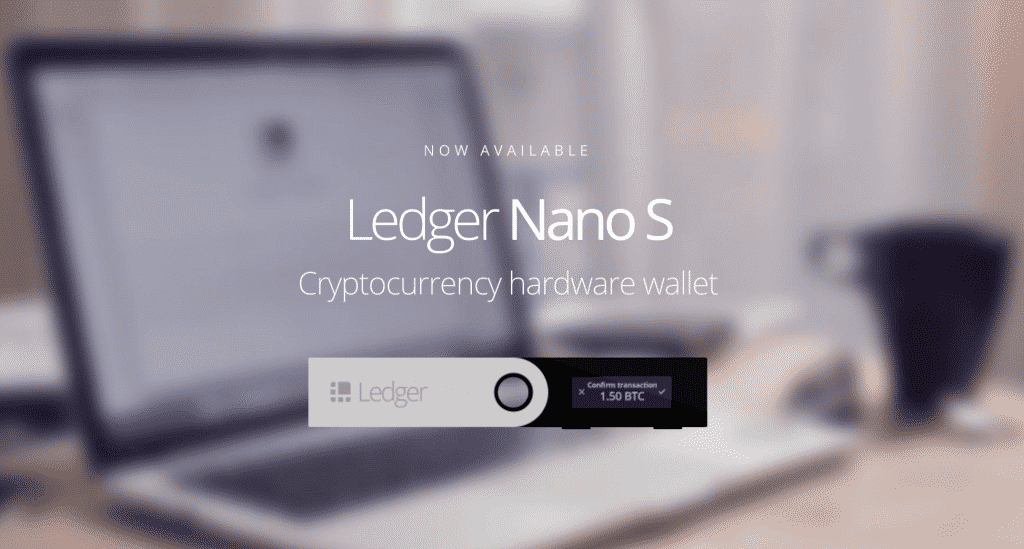

Rather than using a wallet it is therefore better to freeze your digital belongings in a sort of "cold room", which could be a computer disconnected from the Internet or a USB drive specialized in doing this, called hardware wallet . However, this is obviously not an option for everyone: limiting ourselves to hardware wallets, we can remember how the most well-known devices such as Trezor and Ledger cost about 100 euros, and which in addition add complexity and new steps to each transaction. Software wallets, on the other hand, are generally free and easily accessible even if they are ultimately less secure.

The software portfolios

Having seen and considered that we have named them, we can deepen the theme by recalling how there are three different main forms of software portfolios. The first form is represented by desktop portfolios, software installed on the computer that provide a lot of control over its resources but, if connected to the Internet, remain vulnerable. An infection from malware, remote acquisition from your computer or, even if you are not online, a hard drive failure could be a real catastrophe.

An alternative is represented by online portfolios, ie those "hosted" on a website. This makes them convenient because they are accessible from any device connected to the Internet, but the downside is that your private keys are (theoretically) known to the website owner and, technically speaking, there is no much that prevents them from taking your cryptocurrencies.

Additionally, you can opt for wallets through mobile app, optimized for retail transactions, or to pay for goods with bitcoin or another criptovaluta. However, considering that in this case the encryption keys are stored on your phone, if you lose your phone ... you also lose your digital coins.

So what to do?

Whether you choose a hardware wallet or software wallet, there are a number of things you can do to keep your cryptocurrency stock safer. For example:

- beware of online services, because any device connected to the Internet is vulnerable;

- encrypt your wallet with a secure password;

- make regular backups and store cryptocurrencies in multiple locations;

- use a form of multi-sign security to better keep control of your cryptocurrencies even if one of the devices is compromised.