on the crypto

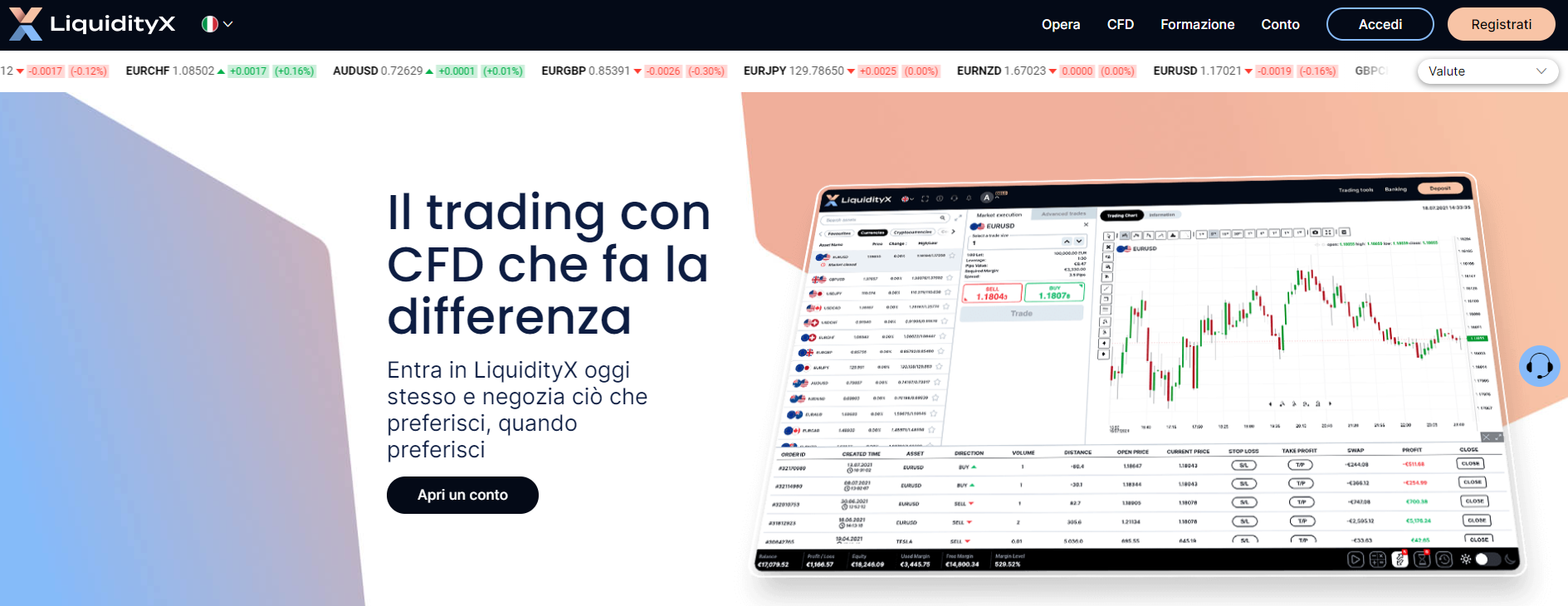

What is LiquidityX

LiquidityX is a broker that offers educational tools, different account types and the industry standard MetaTrader 4 trading platform to its clients.

Owned by Capital Securities SA, LiquidityX is a broker that provides, “an easy and safe experience” for its traders. The broker is regulated by the Hellenic Capital Market Commission and allows its clients to invest in CFDs with a wide range of assets.

Investors who love the MetaTrader suite will be happy to know that LiquidityX provides the MT4 platform.

In addition, it also offers WebTrader for desktop devices. Finally, a wide range of tools and educational resources are available on this broker. Overall, LiquidityX has a lot to offer its clients, as you will see in the following sections.

Who can use LiquidityX?

Judging by its educational tools, LiquidityX is recommended for all types of investors, regardless of their experience. This broker seems to want to teach its clients how to trade CFDs and this feature is something novice investors can be grateful for. At the same time, the layout of MetaTrader 4 indicates that LiquidityX is suitable for even the most experienced investors.

Main features of LiquidityX

LiquidityX offers its users many interesting features, which distinguish it from the competition and the usual online brokers. Here are which ones:

No commission

Withdrawals simple and at no cost

Free trial account

Free tools

Free didactic material

LiquidityX investment elements

When looking at the investment elements, there are three areas where LiquidityX excels: educational tools, the option to be a professional client, and the resource calculator. We will discuss each of them in more detail below.

Teaching tools

Investors looking to learn more about trading will be delighted with what this broker has to offer. Trading information pages for major assets including Forex, Commodities, Precious Metals, Energies, Stocks and more are available in the “CFD” section of their website. These pages not only provide an overview of the resources, but also provide the advantages and disadvantages of investing in them.

Other educational features included are TipRanks, Trading Central, an economic calendar, glossary, investment strategy guides, technical and fundamental analysis, margin information, leverage, and Non-Farm Payroll (NFP).

Trading Central centralizes investment features such as economic recommendations, daily market analysis, analyst insights, interesting ideas, the TC Market Buzz tool, strategic newsletters, the TC Polling platform, and a web TV channel. Overall, LiquidityX's educational features are strong.

Options for professional clients

If you want to be classified as a Professional Client, LiquidityX can make it possible for you. Keep in mind that being a professional client does not qualify you for ICF compensation. If you are classified as a professional client, you will receive benefits such as negative balance protection, a dedicated account manager, Trading Central signals, VIP Platinum training, increased leverage and segregation of your funds. The bullet points below provide a summary of each of these benefits:

- Negative Balance Protection: You will not lose more money than is in your balance.

- Account manager: You can receive personal support from an account manager who works with LiquidityX.

- TC Signals: You can get daily reversal signals as well as news updates when you are a professional client.

- Highest Leverage: Professional clients can invest with a leverage of 400: 1.

- Segregation: Your funds will be kept segregated in bank accounts.

Resource calculator

Third, another great investment feature LiquidityX has to offer is its resource calculator. This calculator will give you a breakdown of the rates you can expect for your investment, improving transparency.

It is available regardless of whether you are a professional or retail client, the currency of your account, the amount of your investment, the type of account, your assets and the duration of your position. Press "Buy" or "Sell" and you will receive a rate calculation.

LiquidityX is a reliable broker

An indicator of trustworthiness is the investment platform used by a broker. If the platform is untrustworthy, you may encounter problems while trying to trade. With this broker, you can take advantage of MetaTrader 4, which is an industry standard. MetaTrader 4 is one of the most popular trading platforms in the world and its users around the world have positive things to say about it.

Some of the MT4 options include the ability to invest with CFDs, market price analysis, trend line monitoring, and automated trading tools. The MT4 platform offers its clients three types of charts, more than fifty technical indicators and many opportunities to customize what you are working on. You can download MT4 or invest online via your web browser.

LiquidityX offers a great user experience

In addition to high-tech platforms and educational tools, users will appreciate LiquidityX's multilingual customer service. One indicator of a positive user experience is the quality of customer service. You can call, email or chat online with a broker representative if you have any problems.

Responsiveness is a good sign of a positive user experience. While not many LiquidityX ratings and their interaction with users are available online, it is still a good sign that customer support is widely available.

Compliance and regulations

LiquidityX is managed by a Greek investment firm called Capital Securities SA, which operates under the regulation of HCMC (the Hellenic Capital Market Commission) under license number 2/11 / 24.5.1994. Capital Securities SA provides services to clients living in the European Economic Area (excluding Belgium) and Switzerland.

Advantages and disadvantages of LiquidityX

+ Variety of investment tools.

+ MetaTrader 4 available.

+ Four different account types.

+ Free didactic material.

+ No trading fees.

- Only one free withdrawal for some accounts.

- Very new broker.

Final thoughts on LiquidityX

LiquidityX offers its customers a lot of educational material and tools. Its users also benefit from the use of MetaTrader 4, an investment industry standard that allows you to enhance your trading experience with its features and add-ons.

FAQ

Are my funds safe with this broker?

According to LiquidityX, private information is highly protected. LiquidityX uses 128-bit SSL encryption provided by Thawte to secure transmissions and ensure that you are investing in a secure environment.

How do I register?

You can sign up at LiquidityX.com by clicking on the 'Sign Up' icon located in the upper right corner of the broker's website. You will be asked to verify your identity, but you will not have to deposit until you are ready to invest. To verify your identity with the broker, you will need to upload a valid photo of your passport, driver's license or national ID card. You also need to prove your residence and finances. More information is provided on the LiquidityX website.

Are there any downtime costs?

As is common with many brokers, you will be charged an inactivity fee if there are no transactions on your account for a period of a month or more. Fees will be charged monthly as long as there is no activity on your account (i.e., when a transaction is made).