But what is this change to come?

Those who read these lines will say that I was seduced by Russian propaganda, others will cry to heaven that we have finally understood that the villain of the film is the United States. But I'm not writing this article to point the finger at alleged enemies of society or to delve into conspiracy theories. I do this because I am seeing a paradigm shift and I think it is extremely important that we all have our eyes on this transformation.

But what is this change to come? Well, simple: people no longer want to use other people's money, they realize the disadvantage of having “borrowed money” and are clamoring for a currency that resists censorship and abuse of power. Ergo, Bitcoin (here quotation in real time). And I'm not making this up, it's part of the demands bitcoiners have been making for more than a decade and are now led by the leaders of US-sanctioned countries.

History has repeated itself over and over in recent years. First it was Venezuela that, faced with US sanctions, decided to create its own cryptocurrency pegged to the price of oil and tried to trade its crude oil production in currencies other than the dollar. Iran was another nation to follow suit: promoting cross-border payments with cryptocurrencies and legalizing cryptocurrency mining in the region; a move that was also generated to finance itself after the economic sanctions imposed by the United States.

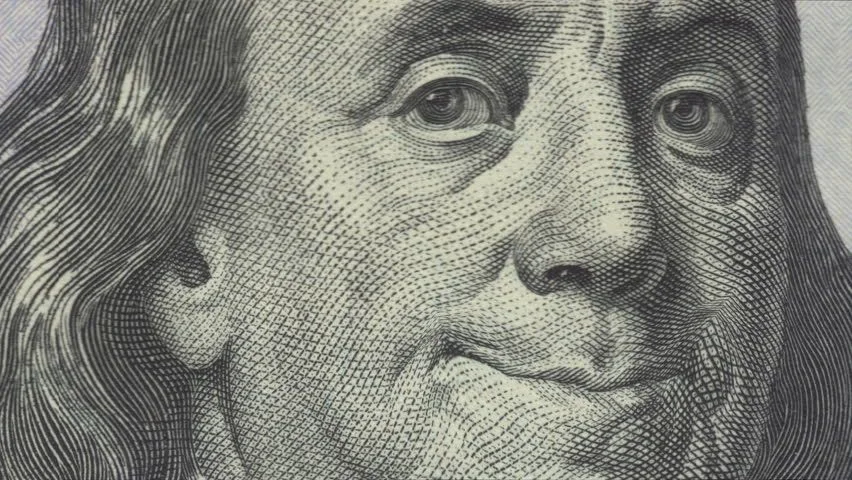

The dollar continues to weaken

The list doesn't stop there: China, a major player in the international market, has also complained about US financial practices and is promoting the use of the digital yuan to gain power in this sector.

The struggle has even reached the oil industry, where China is now seeking to exchange contracts with Saudi Arabia in yuan. A move that could be the beginning of the end of the petrodollar hegemony, a financial phenomenon that we explained in cryptocurrencies last year and that we should all be aware of in order to fully understand the complexity of this crisis.

Beyond these factors, all motivated by the international policies of the United States which have been largely in conflict with countries that do not conform to the political vision of the West or with regimes that are difficult to classify as "democracies", the reality is that day after day the dollar continues to weaken as a global currency and bitcoin strengthens in this narrative.