on the crypto

Malta is considered the Blockchain Island by all those who work in the cryptocurrency sector. A definition due in particular to the fact that the island itself it was the first in the world to provide a legal framework for cryptocurrencies. In particular, three bills were approved in the 2018 to allow Malta to stand out as a real paradise for the many companies engaged in the digital asset sector, or the Malta Digital Innovation Authority Act,Innovative Technological Arrangement and Services Act and Virtual Financial Asset Act. A move justified by the Maltese Premier, Joseph Muscat, as the decisive step towards the affirmation of a new economy in which digital uniforms are destined to take on the function of real money.

To make the intentions of the Maltese government even clearer, in the middle of the same year the Minister of Transport announced a partnership with the British company Omnitude, born with the intent to revolutionize the sector through the use of Blockchain technology.

A series of initiatives that have attracted the attention of a long list of companies in the sector, starting from Binance, always very attentive to government initiatives potentially favorable to the world of digital coins.

The alarm of the European Union

The new regulatory framework prepared by Malta, however, has caused quite a few concerns in the EU, in line with the rest of the warnings that have come several times since European Central Bank.

It was the information portal Malta Today to publish an article which states that continental institutions would have asked the Valletta government for a enhancement of the resources deployed so far in the fight against financial crimes. A need made even more acute precisely by the growing popularity of cryptocurrencies on the island, where many of the companies operating in digital assets have found refuge. In particular the EU in its recommendations to the Member States asked Malta to adopt anti-money laundering regulations able to prove truly effective against activities aimed at washing dirty capital which are one of the logical corollaries to the possibility of anonymity connected to the use of cryptocurrency.

It should also be stressed that the EU itself has judged The staff on which the Police Economic Crimes Unit can count are absolutely insufficient, precisely in consideration of the entity of the phenomenon and the task to which it is called.

A judgment shared by the Maltese banks

The alarm launched by the EU falls at a very particular time. In March of this year, in fact, the Times of Malta he had published a report according to which the Blockchain companies would find significant difficulties in opening bank accounts. A news that had been confirmed by law firms and financial companies consulted by the newspaper, which had stated that the behavior of the banking institutions was due to the fact that the companies linked to digital assets would present a too high risk profile.

It was then Silvio Schembri, Parliamentary Secretary for Financial Services, to specify that some banks had declared themselves in favor of opening accounts for companies in the blockchain sector, but not for those in turn operating with cryptocurrencies, also specifying how it would be absolutely appropriate to make a clear distinction between the two types of companies.

Malta's activism

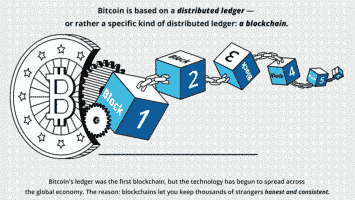

Malta's activism in promoting cryptocurrencies was later confirmed at the end of 2018, when the island played a leading role in drafting a joint declaration with 6 other countries in the area (Italy, France, Spain, Portugal, Cyprus and Greece) where the intention of promote regulation of the use of Distributed Ledger Technology (DLT) in the region. A promotion deriving from the belief that this technology could prove to be invaluable for the economies of the countries involved.

In particular, the document mentioned among the sectors that could benefit from education, transport, mobility, shipping, the land register, customs services, the business register and health care. Furthermore, the Blockchain could prove decisive in order to erect barriers capable of protecting citizens' privacy more strictly and make bureaucratic procedures more efficient.

The dynamism shown by the Maltese government, however, is observed with considerable curiosity by the companies of the countries that have signed this declaration. Starting fromItaly, where a recent report promoted by the Ministry of Development has announced that in our country there is a real boom in startups characterized by a technological background. Companies that, without a structure to rely on and a comfortable environment in which to develop, they may soon start looking around. Considered that already major companies have made their way to Malta, many observers are ready to bet on their departure to the island in the event that our country fails to launch a regulation in a few months that can support it development in a concrete way.