on the crypto

Over time, any cryptocurrency project starts showing the market whether it can live up to any disruptive potential or if you keep stumbling and a wrong script turns out to be too big a barrier to be discovered. In the worst case, projects are abandoned when the sector is in a difficult period or a downtrend.

In other cases, a token's usefulness takes years to develop properly, so time is fully used up for the value and perspective it provides. The end result in these situations is a currency like Covesting (COV), which was born close to the completion of the last bull market, but as the team behind the project remained consistent with its plan, the project is active today and continues.

The example is remarkable in an industry where new projects pop up every day. Here's an in-depth look at the full evolution of the VOC native use token from its inception to where it is today, along with a preview of what's coming for cryptocurrency.

Past: release of the COV token and incorporation of cryptocurrency copy trading

The COV token was released in late 2017 as an initial currency offering, allowing cryptocurrency enthusiasts to gain early access to a utility token that would be used natively in a copy trading module that would be released at a later time . The plan for the copy trading module was ambitious and would connect followers with strategy managers and include a global ranking system.

Token sales sold out almost immediately, highlighting the demand for innovative cryptocurrencies at the time. In just a few months, Bitcoin and Ethereum suffered a dramatic collapse and took wings from the industry and prevented innovative projects in space. Interest in all the projects has waned for a while.

Covesting, a European-based fintech software developer, sought and received one of the first DLT licenses at the time. The license limited specific business models that were crucial to the copy trading experience. As a workaround, the company decided to develop its copy trading software as a third party module available for partner licensing.

The trading model proved to be the right decision, allowing for more development time and combining the copy trading module with the right trading partner to make its debut. In early 2020, the copy trading module left the beta stage and was introduced to the world for the first time. The initial setup happened first without any COV token integration, but the Coovesting team subsequently introduced support for the COV token at a later date, which is available today.

Present: the Cowesting copy trading module and the COV usage token

Covesting is a peer to peer copy trading community that connects followers with strategy managers through a software module within the PrimeXBT dashboard. Coovesting's copy trading module is currently available exclusively on the award-winning leveraged trading platform, known for its long and short positions in over 50 different CFDs; However, B2B partnerships can always expand into the cryptocurrency industry at any time.

With a Cowesting account, anyone can become a strategy manager if they feel they have the necessary skills. The software itself and the transparent risk and success metrics provided by the global rankings make these strategy managers work hard and honestly. It also allows followers to select the strategy manager that best fits any personal goal or risk appetite.

Followers can follow one or more strategies at any time and can manage these positions in a similar way to stop loss or take profit margin trading positions. The module will allow your followers in general to automatically copy all the operations that the strategy manager performs. If successful, the followers will receive a share of the profits. The strategy manager also gets a share.

Strategy managers, in turn, will be able to raise capital much faster and access new sources of income. At the same time, followers who might not otherwise survive in the markets can now benefit from those with more experience. They must then compete with other strategy managers to climb the fully transparent global rankings or earn all five stars, each with unique parameters of risk, success, revenue or leverage.

The Covesting Token (COV) is the native cryptocurrency of the copy trading module, initially released as an ERC-20 token. Since then, Coovesting developers have linked the Binance Smart Chain for greater flexibility between chains and to allow users to take advantage of the many decentralized protocols and applications unique to each blockchain.

The native utility token was released with a maximum total supply of 20.000.000 VOCs, making it scarcer than BTC. Deflationary Tokenomics further reduces token supply through the systematic token burning initiated by Cowesting developers. More than 660.000 VOCs were burned with these methods.

Users can track supply and other COV token related metrics in the Covesting My COV section on PrimeXBT. Additionally, this section of PrimeXBT's dashboard is where COV token holders can begin to access the utilities provided by the token in conjunction with Cowesting's copy trading module.

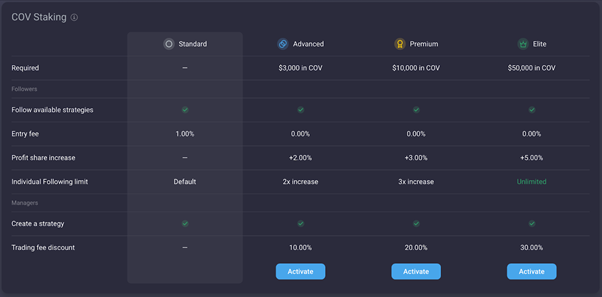

There is also a section dedicated to staking COV tokens in the same My COV part of the PrimeXBT dashboard. COV betting is how users unlock any account level utility within the copy trading module. The greater the number of blocked COV tokens, the greater the number of utilities enabled for the token holder.

Using COV tokens, users can convert a standard account into a Premium, Advanced or Elite account on PrimeXBT. Each of the three levels removes the new 1% scan speed, while the rest of the features differ from level to level.

For example, at the Premium level, followers increase their profit share by 2%. Strategy Managers get 10% off the trading fee and there is a double increase in follower limits. At the advanced level, the follower profit share increases to 3% and the strategy managers get a 20% discount. Your following limits have also tripled.

Finally, the Elite tier offers maximum value and utility, with a 5% increase in profit sharing for followers, a 30% trading fee discount, and no follower cap. With no follower limit, your earning potential is as significant as your reach.

Future: the future of Cowesting and COV

The Covesting development team always seems to have something up their sleeve, be it updates to the copy trading module, VOC-enhanced tokenomics, or something completely new. Earlier this year, they unveiled a tool that will further enhance the usefulness of the COV token. This tool is known as Covesting Yield Accounts.

The Covesting Yield Account system can be found in the Covesting section of the PrimeXBT panel along with the copy trading module, VOC staking, supply statistics and much more. The new tool offers cryptocurrency holders up to 35% APY on their inactive cryptocurrency tokens on PrimeXBT.

Everyone has heard of DeFi. Among the most popular ways, this new cryptocurrency industry makes money for token holders through variable returns that are paid out as rewards. Several DeFi protocols have unique ways of doing this, but perhaps the most popular example recently is how it works with automated market making platforms like Uniswap and PancakeSwap.

In centralized cryptocurrency exchanges, the exchange itself provides liquidity that users can take advantage of. However, users provide liquidity by betting tokens on a smart contract with decentralized exchanges or automated market building platforms. By locking the tokens, there is enough liquidity within the trading pairs to facilitate market activity.

An exchange would generally generate revenue based on this commission-based trading model. Since no company is involved, the DeFi protocol rewards users who offer liquidity as an incentive to do so. When demand is high, the interest rates paid are also higher. That's why interest rates are variable on DeFi in most cases.

The concept behind how everything works is clear, but linking wallets to blockchain and decentralized apps to move and bet coins can be confusing and downright dangerous for those who don't know how to do it.

However, Covesting will introduce the Covesting Yield Account system in the third quarter of 2021, allowing for a simple and intuitive connection to major DeFi protocols such as Uniswap or PancakeSwap, but without the technical knowledge usually required. The Covesting Yield Account system dashboard connects directly to the PrimeXBT dashboard.

Using the tool, users can much more easily access the industry's best variable APY rates that DeFi has to offer. It was also here that it was revealed that the most recently announced COV token utility has an impact. According to company blog, the COV token can unlock an additional profit of up to 2x more APY on Covesting performance accounts. Users can also now request an initial 1% raise to join an active waitlist in the Covesting Yield Account section of the PrimeXBT panel.

The next evolution for Covesting and VOC

Ultimately, the fate of the COV token can be determined based on where the cryptocurrency industry innovates in the future. When the COV token was first conceptualized, DeFi was just an idea; However, today, the utility token has evolved to include the latest trends in the crypto industry as well.

In the future, regardless of where things are going and what features are being introduced into the COV token for additional profit, given the history of creating an interesting value proposition for token holders, what comes next will be a good addition. finance.