on the crypto

Is it wise to buy Prysmian shares today? But above all, is it worth buying them on the stock exchange or investing in CFDs? Those interested in doing this need precise answers to these two questions. Although Prysmian is one of the leading companies on the Italian stock exchange, it does not mean that it is a safe investment.

Aside from that, the most important thing is to understand how and where to buy Prysmian shares. For example, not all novice investors know that it is possible to invest in Prysmian shares immediately, through a regulated and safe broker like Libertex. We will explore this possibility further later.

But before starting to buy shares in any company, it is necessary to inquire about the company itself, in order to understand how its stock could move in the future. It is one of the oldest companies in Italy and its shares attract the interest of many investors.

Prysmian Borsa Italiana shares: focus on the company

This Italian company deals with wiring and cables. In practice, it deals with the production, sale and installation of cables. This is the main branch of the company, but an equally important secondary one, is that of telecommunications.

Prysmian owns 90 production sites around the world and of course, the main ones are located in Italy. Market shares in Italy and Europe are the most important, but it also enjoys an excellent position in Asia and America, both in the north and in the south.

The company stands out above all for the excellent relationship it maintains with its shareholders. Shareholders organize hundreds of meetings each year to disclose the company's quarterly and financial results, as well as to show the Prysmian share price. This is done to keep shareholders always informed on Prysmian share performance.

Should I buy Prysmian shares in the bank?

There are still many investors who nowadays resort to banks for the purchase of shares. This is because it is thought to be the safest way to do it, but is this really the case today? In fact, many investors say that investing in a bank can also be reliable, but certainly with the commissions to be paid, earning is very difficult.

Furthermore, the investor does not have the possibility to control his investment in any way, because his money is managed by third parties. The only advice we can give you in this sense is to rely on the best banking institutions and hope that everything goes well.

Here is a short list of all the disadvantages offered by banking trading:

- No choice - It is a bank advisor who manages your money and you can't make any moves other than signing the contract.

- Transparency not at the top - Banks should make the Terms and Conditions offered to their clients clearer and more transparent, and several institutional bodies are working with them to ensure this happens as quickly as possible.

- Uncertainty of Results - Relying on a bank is safe, but it is by no means a success rate. Bank interest rates are very low and often you have to wait years to be collected.

Buy Prysmian shares in real time

Fortunately, there is no shortage of alternatives for investors in bank trading. These are especially CFDs or Contracts for Difference. In particular, it is a financial instrument, completely legal, accessible and easy to use, with which it is also possible to buy Prysmian shares. But how does it work?

Just follow a very simple procedure to buy Prysmian shares. CFDs are contracts that are entered into between a broker and an investor. Each company stipulates different contracts depending on its trading conditions. One of the most recommended by the Prysmian shares forum is Libertex.

Here are the advantages offered by CFDs:

- Possibility of intervention - Investors who operate via CFDs to buy Prysmian shares can intervene at any time. So, if things don't go as assumed, it is also possible to exit the trade.

- Low Commissions - Unlike banks, brokers charge lower commissions to their operators, precisely to incentivize them to use their services.

- Higher Earnings - Consequently, by paying fewer commissions, your earnings also improve.

All this makes the value of Prysmian shares even greater, making CFDs the ideal tool for trading them profitably. If you want to start investing with CFDs, continue reading and find out how to do it with Libertex.

How to create an account with Libertex

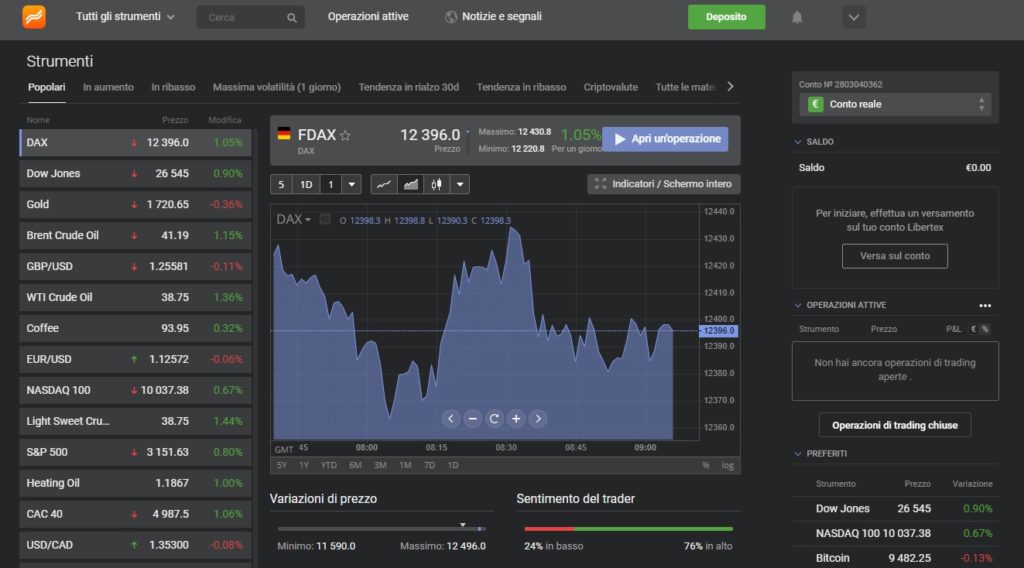

Another platform you can use for stock trading is Libertex. This regulated broker is used by many novice traders, because it offers a platform that is easy to use, but at the same time powerful thanks to the possibility of using many functions.

If you would like to take a closer look at this platform, you can do so by following the steps below:

- Register on the Libertex website and verify your identity within 30 days so as not to lose access to the platform.

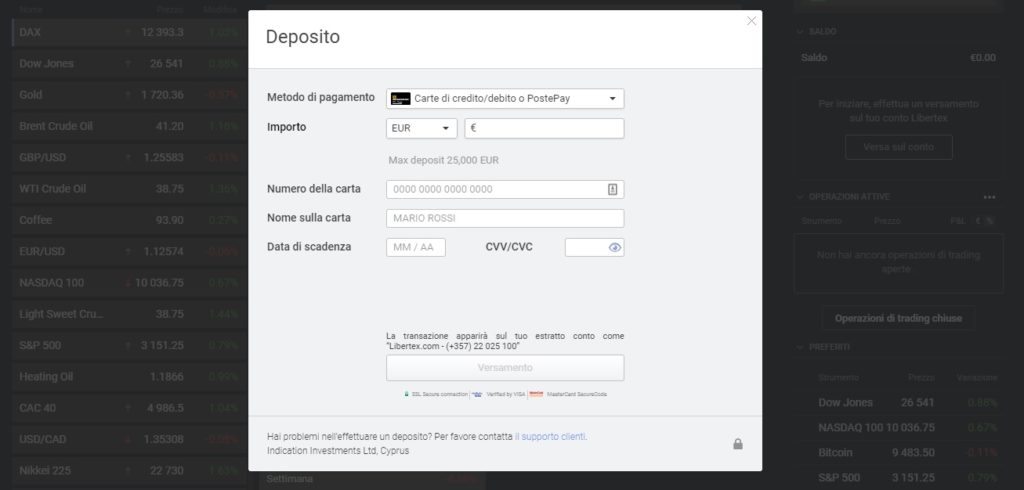

- Finance your account by making a deposit of your trading capital, using one of several accepted payment methods.

- Now you just have to use the platform to trade live and buy or sell shares like a real expert.

If you use a mobile device, iOS or Android, you can access Libertex even on the go. Just log into the mobile browser website to track your operations, so you never have to worry about downloading or updating the app.

Prysmian dividend shares

The dividend shares of this company are very attractive. Usually the shares were traded above 40 cents, only in 2011 and 2012 they passed to around 20 cents. With a dividend like this, there may be interesting added values at the time of detachment.

Although owning a CFD does not mean actually holding a share, it must be said that Prysmian shares allow you to obtain a very attractive premium, if you hold an open position at the ex dividend. One of the advantages offered by CFDs, however, is that it is possible to make money with both rising and falling stocks.

What influences the performance of Prysmian shares

Now that we have understood the cheapest, safest and most reliable way to buy Prysmian shares, the time has come to understand what are the aspects that can influence the performance of the company's shares.

As mentioned above, this Italian company is engaged in the production of cables, so the first factor influencing the performance of its shares is the price of the raw materials used for production. Copper is therefore the raw material in question to keep an eye on.

Since Prysmian is also involved in telecommunications, it is also very useful to keep an eye on the costs of communications and energy to analyze the performance of its shares. From this point of view, any spikes in their price could lead to a fall in the price of Prysmian shares.

Our conclusions

From what you have read in this article, it is clear that buying Prysmian shares is no longer within the reach of only large investors. Nowadays, it is also possible to do this with regulated and safe platforms such as Libertex and financial instruments within everyone's reach such as CFDs.

When trading in this way, it is also important to mention the possibilities, but also the risks, offered by leverage. To control risk, you can use proven risk management strategies, or find the right balance between exposure and willingness to take risks.

However, the cornerstone of everything remains the broker mentioned on this page, which immediately makes it clear to all investors the risks associated with using CFDs to buy Prysmian. Of course, some might say that since they are regulated brokers it is mandatory for them to do so, but we can assure you that this is not always the case.

Libertex offers its customers numerous tools that allow them to purchase not only Prysmian shares, but also many other companies from around the world, and also trade cryptocurrencies, currency pairs, raw materials and more.

If you found our advice useful, why not put it into practice straight away? Just log in to the Libertex website to get started. Using the demo mode you will have the opportunity to trade Prysmian shares without spending a single cent and thus you will be able to understand whether it is something that is right for you or not, at no cost.