on the crypto

Thanks to this short article, you will be able to find out how essential it is to know the history and evolution of Saipem shares, before purchasing them. Knowing the value of Saipem shares and what fluctuations the stock has had in the past, considering what have been the absolute best times to buy Saipem shares, could give you a better picture of how to act.

Saipem shares could really be the one for you that you have decided to invest a part of your capital in shares.

In a historical moment like this, deciding to invest and buy Saipem shares could really benefit your economic condition from here shortly and try to make the most of it even when in effect you are in a bit of difficulty. There is not necessarily a need to invest large capital and in fact you could start with a somewhat smaller sum.

Take the value of Saipem shares into account

Knowing the value of a Saipem share may seem trivial to you, but it is not at all. This is the minimum information to know before deciding to buy the title. The value is not a fixed thing over time and it would therefore be good to take into consideration several factors that have had a certain importance in determining this value. Patience is certainly the virtue of the strong. Precisely for this reason, we advise you to have enough.

If you are ready to go and your determination knows no bounds, you need to know what the cost of a Saipem share is. Saipem shares must be observed in real time. Precisely through this method of observation you will know precisely the value of Saipem shares today, that is, what nominal value the Saipem shares have in effect and later you will be able to know whether or not it is worthwhile to buy this security at this precise moment.

What tools can be used regarding the Saipem share prices

To be truly equipped to be able to determine the price of Saipem shares, to consider the forecasts on Saipem shares and for all other shares reliable, there are excellent tools that we recommend to use and exploit, in order not to make a sensational hole in the water. .

On a visual level, a chart of Saipem shares will be able to indicate very quickly and accurately what the trend of Saipem shares is on the Italian stock exchange and also in which direction the market is moving in general.

Will we be able to make effective predictions regarding Saipem shares?

To evaluate the performance of Saipem shares and consequently make effective forecasts, it is necessary to study very carefully what are the market movements that may affect this specific stock.

It is not easy to foresee and prevent a collapse of Saipem shares to save one's capital, in the event that it is seriously endangered. However, the more data is available to you, the more precise any forecast will be with respect to the performance of the Saipem shares that you want to make.

What are dividends for Saipem shares?

The dividend of Saipem shares is intended to indicate to all intents and purposes the portion of profit that in a given period, whether at the end of the month, at the end of the quarter or otherwise, is distributed among all the shareholders who believed in that particular share. In this way, it will not be compulsory to sell one's shares in order to obtain a profit, but it will be possible, on the contrary, to appreciate dividends and buy other Saipem shares.

What could happen to stocks when there is a dividend?

Very often, it happens that immediately after the distribution of the dividends of the shares, there is a general interest in selling this stock. This can of course happen with Saipem shares or with all the other shares that can be bought or sold on the Italian stock exchange.

However, the past experience of a redistribution of dividends on a rather regular basis could attract investors once more and transmit such confidence that it can encourage the purchase of Saipem shares in all respects, compared to another stock. stock that does not follow the same strategy.

You may decide to consider, depending on how often dividends will be split, if and when to buy a particular stock. Take this as an incentive, but a little more analysis is still recommended and should not be the only assessment you should make when you are about to take action in the stock market.

Conclusions

Being able to move with a certain agility within the stock market, in order to be able to earn as much as possible, is really very complex. You may be lucky and have chosen a particularly fruitful action, but this is not enough in the long run. It takes method and effective aniles, which will allow you to move with a little more confidence and be less subject to the unpredictability that you will have to face in any case.

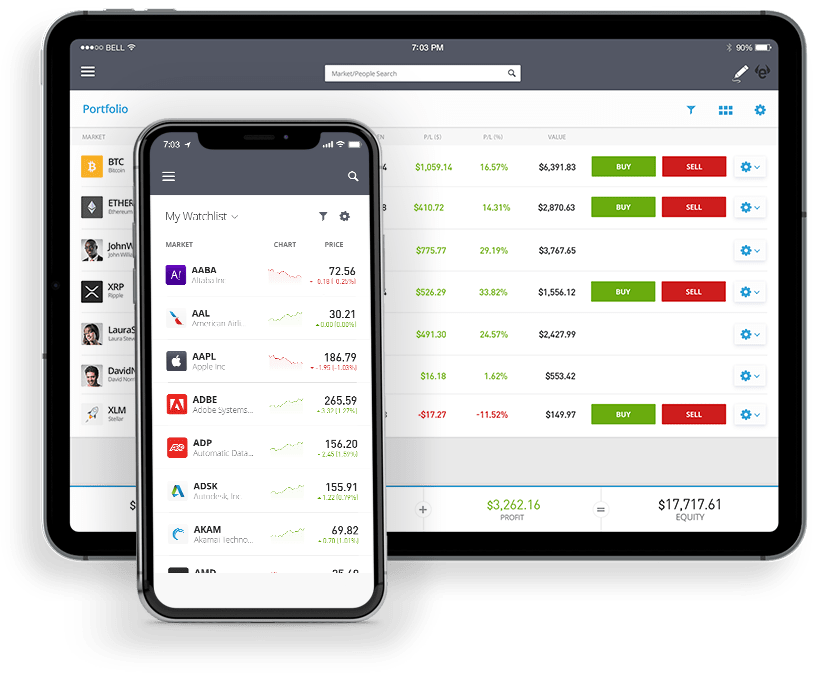

One truly appreciable thing is being able, nowadays, to purchase Saipem shares through a simple click on an online trading platform, which among the countless advantages also gives us the possibility of doing everything comfortably from home, without going to bank or spend more money on an intermediary to do the work for us.

Of course, this implies a greater effort in studying the functioning of the stock market and the Italian stock exchange, but if you do not lack time and the desire to learn new things, you can approach this new earning opportunity with the right enthusiasm.