on the crypto

Se interest in technology Blockchain, on which the cryptocurrency sector is based, is constantly increasing, in the last few hours a important opinion that seems destined to have a lot of discussion for the problems it faces. It was released Gartner, an important research and consultancy company, which has published a very detailed study and in which in particular a rather demanding forecast is advancing, affirming how by 2021 approximately 90% of current blockchain implementations in the enterprise sector will have to be reviewed and modified, if they want to try to remain competitive and safe, thus avoiding technology obsolescence.

To understand the importance of Gartner's prophecy, it is also necessary to remember how the company is a world leader in its sector and is part of the S&P, providing assistance to more than 15 thousand companies in over 100 countries located throughout the globe, to regardless of sector or company size.

The Gartner report

The report in question starts from a finding of Adrian Lee, senior research director, according to whom blockchain platforms are emerging realities and, to date, many of them are almost indistinguishable from each other, prompting many observers to overestimate their capabilities and short-term benefits, therefore expecting a decisive help from technology for the achievement of its business objectives that cannot arrive. An unrealistic expectation e such as to push companies to fairly senseless choices, for example by choosing fragmented offers that overlap each other or are used as a complement. Furthermore, the suppliers of these platforms do not have the appropriate professionalism to actually help companies choose based on their actual needs. In many cases, in fact, the secure transactions that characterize the technology in question do not represent a strategic objective of the company that wants to adopt it.

It is a really critical picture, the one outlined by Gartner, which however does not hide as despite this, the Blockchain is destined to meet considerable luck in the future, so much to establish in beyond 176 billion dollars the value in the 2025, to then even rise to 31 trillion five years later.

A provision that accompanies the exhortation reserved for product managers, who should prepare for an evolution so rapid as to prefigure early obsolescence and an extremely competitive and, therefore, changeable scenario. Especially in the first phase, the one at the turn of the 2021, the situation could be characterized by potential failure of many companies, even 90% of those on the market.

A forecast to be taken into account

The study by Gartner and the forecasts contained therein seem destined to serve as food for thought for many, at a time when despite the distrust of virtual currencies On the other hand, appreciation for Blockchain technology is growing more and more. Just think of the words expressed by Mario Draghi over the last few months, or to the authoritative support of many protagonists of the financial or political world, to understand how more and more those who look to it as a tool that could prove useful for the purposes pursued and the processes that characterize the world banking, and more. The characteristics of speed and safety on which it is based make it a possible means of solving for example the problems of digital transactions and for this very reason many banking and financial institutions have not hesitated over the past few months to enter into agreements with companies that gravitate in the blockchain field.

To take advantage of it could it be HashGraph?

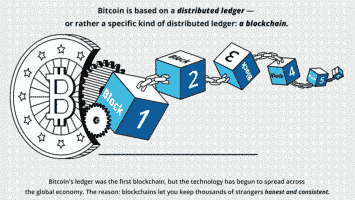

The shrewdest observers of everything that moves in the technological field will not have been slow in putting Gartner's report in relation to a recent news, that is the development by Swirlds, a software platform, of the HashGraph algorithm. It's about a Distributed Ledger Technology higher, capable of eliminating two significant problems affecting the Blockchain, namely the need for massive calculation (mining) and currently unsustainable energy consumption on which the applications based on it are based, starting from Bitcoin and Ethereum. To understand the technical superiority of the new algorithm, just remember that the transactions guaranteed by HashGraph are 50 thousand times faster: in a second more than 250 thousand occur, against just 7 of Bitcoin.

Another sensational advantage is then that in terms of safety: in the case of HashGraph, in fact, no member of the community can prevent the community from reaching consensus and not even modify it once it has been reached. A certainty that clearly clashes with what happens in the Blockchain universe, where consensus can be considered at most a probability that increases over time. Just the failure to reach consensus then has a dramatic consequence, in the form of conflicts destined to perpetuate itself in a sort of permanent civil war. The most evident testimony of what I said is the hard forks that divided the communities of miners and created Altcoins like Bitcoin Cash and Bitcoin Gold.

Finally also from an economic point of view HashGraph can highlight the superiority deriving from the fact that is around Proof-of-Work (PoW), avoiding wasting calculations to slow down the system itself and thus rendering useless the expensive custom hardware used in the Blockchain, where the new blocks arrived too quickly, can be discarded.

A series of advantages that could soon become evident also to the world of companies to which the Blockchain is addressed and which could be connected to the Gartner study, with unpredictable results.