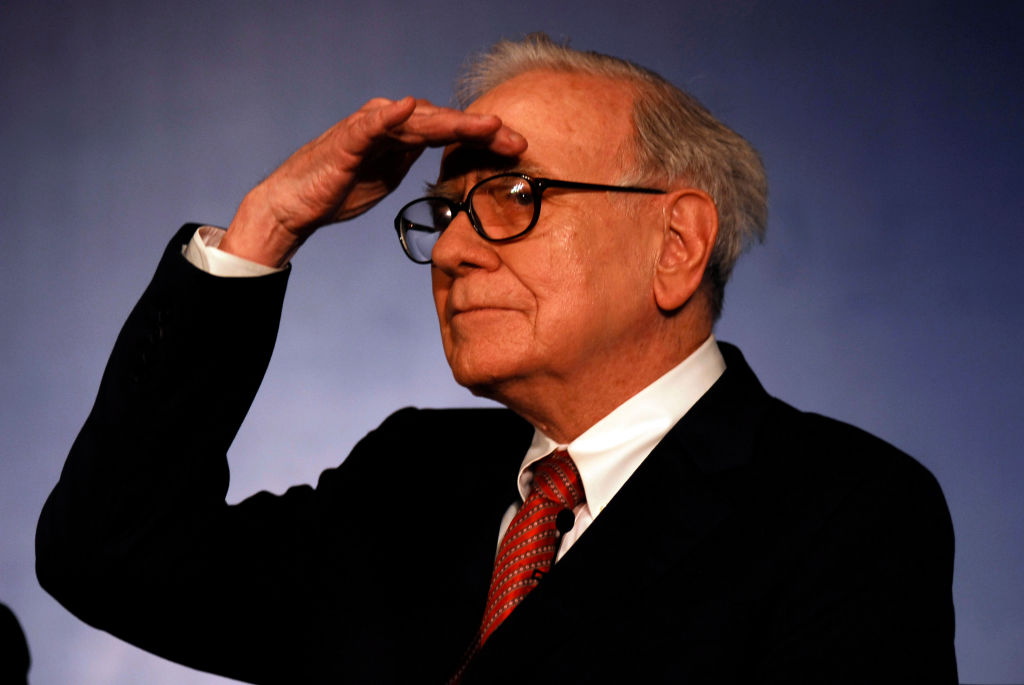

Buffett further stated that he would not buy bitcoin (quotation BTC) not even at clearance prices, unlike how it would buy productive properties and land. The financial specialist said this yesterday, April 30, from the Berkshire Hathaway annual conference in the city of Omaha, Nebraska, United States.

“If you told me you have all the bitcoins in the world and offered them to me for $ 25, I wouldn't take them because what would I do with them? One way or another I should sell them to you (…) but they won't do anything. Your apartment will produce houses and farms will produce food, ”she said.

He also taunted that "there are assets that are considered magical" and said that someone could launch their own cryptocurrency, for example the "BuffettCoin", and it would still be useless.

The main point of Buffett's argument against Bitcoin is that, according to him, cryptocurrency is not a commodity that produces tangible assets or produces concrete returns. "For an asset to have value it must produce something, and besides, we already have fiat currency, so in the end there is no reason for the US government to replace its currency," he said, holding a one-dollar bill in his hand. dollar.

Bitcoin, the least recommended asset by "dinosaur" investors

At the same table where Buffett made his statements was Charlie Munger, who is also famous around the world for his track record as an investor and dared to give his opinion on Bitcoin.

“I have a tip for you too: when you have your retirement account and your advisor tells you to throw your money into bitcoin (BTC), say no,” Munger said, followed by applause from the audience.

Last year we reported that BTC had a larger market cap than 47 of the 48 companies that Warren Buffett owned at the time. Today, it is striking that BTC's market capitalization exceeds that of Berkshire Hathaway, the same company that organizes the conference from which Buffett and Munger have railed against Bitcoin this time.

It is worth mentioning that Munger is a vice president of the Berkshire Hathaway company and that on repeated occasions, as early as 2013, he referred to Bitcoin as "rat poison".

Thus, Buffett's opinion remains the same as his previous statements on the usefulness of Bitcoin, as during 2020 he also stated that nothing can be done with this cryptocurrency other than to sell it.

Bitcoin: an asset with many productive corners

You cannot apply the logic of investors like Warren Buffett and Charlie Munger to an asset like Bitcoin, as this cryptocurrency and technology does not function as a business or a commodity that provides returns.

However, as Bitcoin grows, corners emerge and consolidate that allow it to be offered as a valid investment asset.

For example, the adoption of its technology by millions of users is allowing the emergence of companies offering international remittance and remittance exchange services, which is increasing the demand for this good and building a Bitcoin-based industry. .

Likewise, more and more countries are riding the wave of Bitcoin by adopting it as a legal currency, means of payment or a permitted asset, such as Panama, Cuba and the Central African Republic, in addition to the well-known case of El Salvador.

Furthermore, Bitcoin mining is an industry closely related to the production and distribution of energy, which makes its processing power or hashrate an asset with which to make financial decisions and generate returns.

Evidence of Bitcoin's massive adoption is the growth of the second tier network or solution known as Lightning, which has seen a 200% increase in capacity over the past year.

Finally, the speculative approach is also a point in Bitcoin's favor, as the cryptocurrency has steadily increased in value since its creation. Indeed, according to specialists, BTC may now start a new bull rally.